Dharma is often a processing service provider that we love and that buyers love. Not just is Dharma an amazing Option for minimal-risk processing, it also accepts a restricted spectrum of medium- to high-risk organizations. Dharma’s internet site lists many of the small business kinds it accepts:

Modern mortgage rates30 year house loan rates5-calendar year ARM rates3-12 months ARM ratesFHA home finance loan ratesVA home loan ratesBest house loan lenders

Vacation merchants. Sale of airline tickets is just not permitted. Merchants could possibly be turned down dependant on the character of bookings.

Whatever the style of business enterprise you have, it’s vital to abide by high-risk merchant regulations in California.

Luckily for us, a number of the finest merchant account services vendors not just accept high-risk firms but additionally work with them to arrange solutions catered for their wants.

On top of that, PaymentCloud's secure payment processing techniques be sure that your buyers' delicate info is protected and taken care of in compliance with industry benchmarks.

Phone Purchase: People processing telephone orders must manually enter credit card data into a portal to seize payment facts.

Can a high-risk merchant account be effective to my business enterprise? Sure, possessing a high-risk merchant account could be valuable because it allows your organization to accept card payments which might not are already probable with a normal account.

Observe merchant account transaction, batch and authorization volume and evaluate for possible high risk and/or fraudulent exercise.

Any merchant Get More Information who needs to accept bank card payments should have a merchant processor account. A merchant account Get More Information can be an unsecured line of credit that pays a merchant for buyer buys.

These integrations signify that if you’ve currently been making use of an shopping online cart services or possibly a POS procedure in your business, Payline might be able to plug appropriate into your ecosystem.

Of course, a company will require a checking account to procedure payments. Your merchant account services supplier will transfer your money to that bank account as soon as they’ve cleared. Should you’re possessing issues creating a checking account, You can even locate banking institutions that may operate with high-risk firms.

If you’re a web-based seller who has become categorised for a high-risk merchant, you might be asking yourself ways to ideal navigate your problem. Sadly, a lot of entrepreneurs discover that they do not recognize just what exactly the time period, “high-risk merchant account” is till soon after staying classified therefore. Remember, with uncommon exceptions, a company remaining labeled as high-risk is not a personal choice.

As usually, the best way to Get More Information be sure that you receive an incredible deal with your high risk merchant account is to Speak to multiple suppliers and Look at their pricing and service deals.

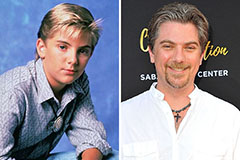

Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!